Do you have an account?

Why create an account?

After creating an account you will :

- have access to the “favourites” feature,

- be able to download certain data published by RTE,

- have access to forms (PKI certificate, EIC code, Customer questionnaire - KYC),

- have access to notifications.

If you are an RTE customer, feel free to contact your administrator so that he or she can give you access to your company’s services.

In a decentralized market, the imbalance settlement price is an important price signal aimed at incentivising balance responsible parties (BRPs) and/or balancing the system.

In accordance with Chapter 3 "Balance Responsible Party System" of the Market Rules, the balancing imbalances account (BIA) centralises the income and expenses linked to the balancing mechanisms and balance responsible parties mechanism. It is therefore the balance responsible parties who are responsible for the imbalances in their perimeter that cover the costs linked to balancing the French power system, on the basis of the imbalance settlement price and in proportion to the volume of their imbalances. In addition, the imbalance settlement price has a coefficient "k" which ensures that the BIA is balanced and sends out an incentive price signal for BRPs to exercise their financial responsibility to balance their perimeter.

Imbalance Settlement Price Calculation

The principles for calculating the imbalance settlement price (ISP) provide a financial incentive to correct imbalances. They reflect the cost of balancing operations by RTE to balance the French power system.

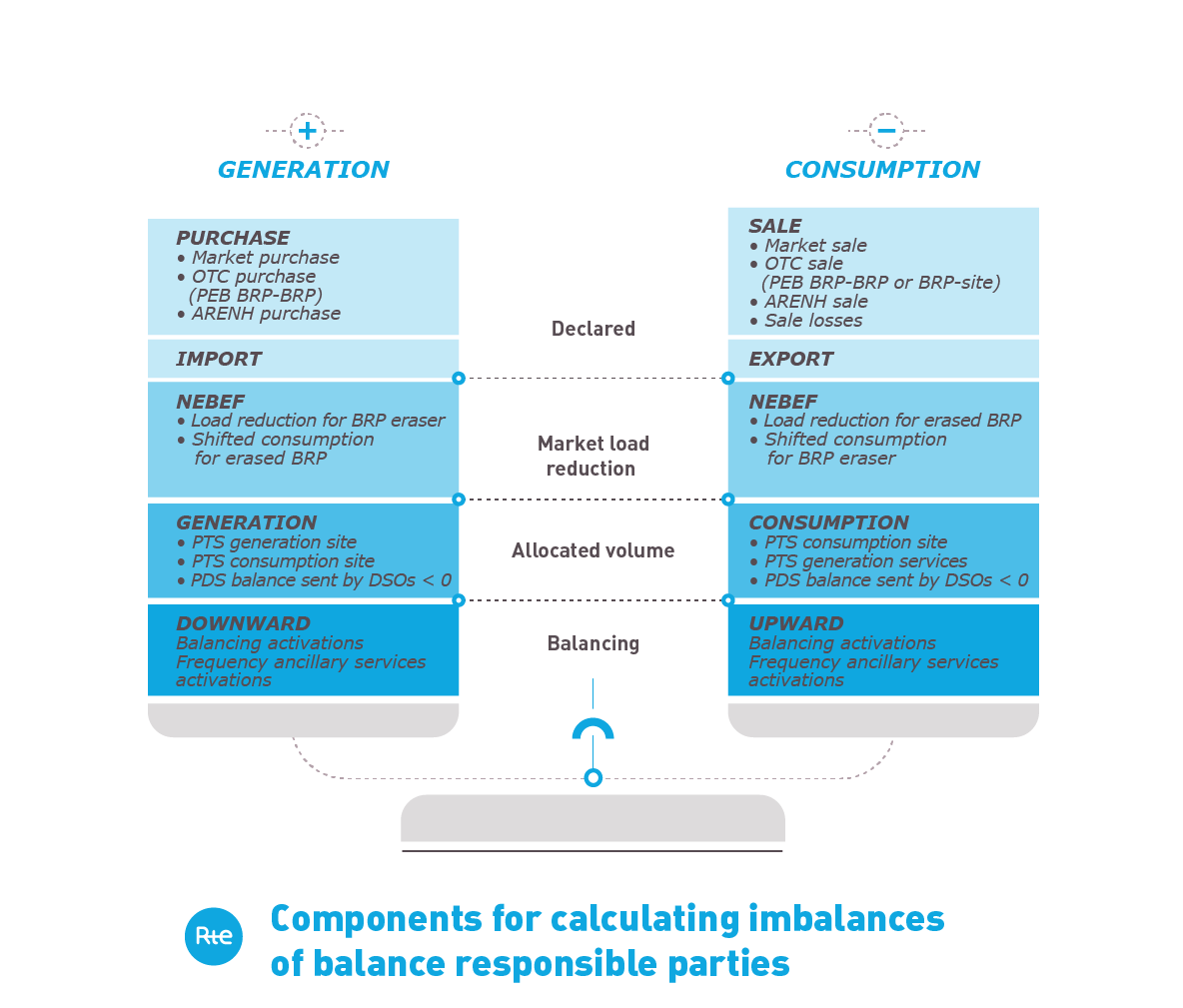

For each half-hourly interval, the ISP is calculated as a function of the balancing trend, the volume weighted average price (VWAP), the applicable value of the coefficient “k” and the sign of the balance responsibility party’s imbalance (plus or minus).

The imbalance is said to be positive (respectively negative) if the remaining balance [generation - consumption] of the balance responsible party’s perimeter is positive (respectively negative). For a positive ISP, the balance responsible party is paid (respectively charged) by RTE in case of a positive (respectively negative) imbalance.

Imbalance Settlement Price Matrix

If the volume weighted average price (VWAP) is positive or zero

If the volume weighted average price (VWAP) is negative

- VWAPU/D: volume weighted average price of balancing energies activated upward/downward (see article 0.O.2.3 “Volume Weighted Average Price” in the "General Provisions" of the Market Rules).

-

The trend is said to be upward if the overall imbalance of the power system is negative or zero (i.e. when the overall balance for France [generation- consumption] of the system is negative), and downward in the opposite case. More details for the calculation of the trend are in article 0.O.2.2 “Trend of the French electricity system” in the "General Provisions" of the Market Rules.

-

Note 1: The Positive Imbalance Settlement Price cannot be greater than the Negative Imbalance Settlement Price.

-

Note 2: The Negative Imbalance Settlement Price cannot be less than the Positive Imbalance Settlement Price.

Invoicing Balance Responsible Party Imbalances

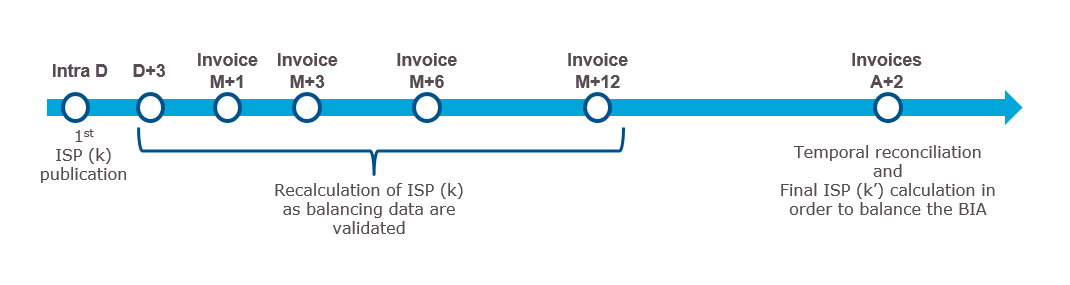

Every month and for each imbalance settlement interval (today half-hourly intervals), RTE calculates the balance responsible parties’ imbalances and invoices them at the imbalance settlement price. The sum of the remuneration of each imbalance settlement interval results in a monthly imbalance invoice.

Prior to the index meter reading of consumers, balance responsible parties are in the “imbalance” process, during which M+1 to M+12 are invoiced. Each invoice date M+X takes into account any update of the ISP resulting from fine-tuning of the balancing volumes and their prices.

Following the index meter reading of consumers, is the "temporal reconciliation" process, which can be used to recalculate balance responsible party imbalances based on metered data. It allows the invoicing of balance responsible parties in October Y+2 for the period from July Y to June Y+1.

Invoicing process for the periods before 1 January 2023

Invoicing process for the periods after 1 January 2023

Evolution of the factor "k"

Factor "k" is a parameter of the imbalance settlement price. It is defined ex ante with the aim of balancing income and expenditure of the energy component of the balancing-imbalances account based on historical data.

For the periods before 1 January 2023 invoices.

For a given calendar year Y (for example 2020), the coefficient "k" is then reevaluated in Y+2, at the end of the "temporal reconciliation" process, which bases the valuation of energy on the imbalance settlement price (i.e. October 2022 in the example), to obtain a "k'” value ex post which ensures the balancing-imbalances account reaches the final balance set by the CRE (in practice the target balance is 0). The final imbalance invoices of balance responsible parties are recalculated retroactively with the new coefficient "k’”. This operation gives rise to the payment to balance responsible parties of the difference between the final imbalance invoices using the ex post coefficient “k’” and the recalculated imbalance invoices previously established on the basis of the ex ante coefficient “k”.

History of the k and k’ factors and associated imbalance settlement prices

This table does not cover periods after 1 January 2023.

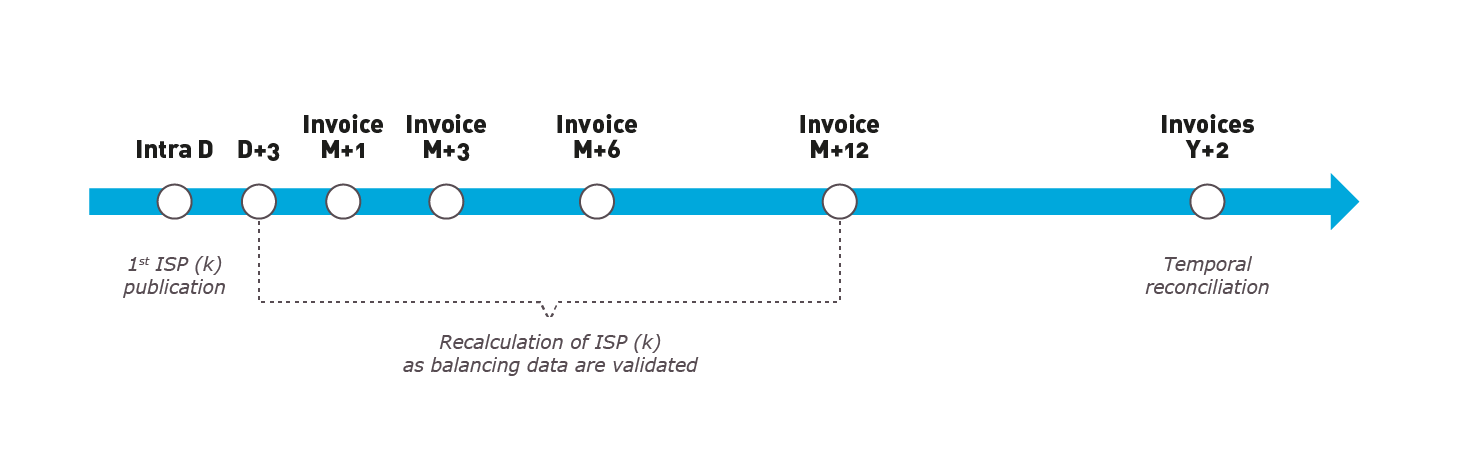

For the period after 1 January 2023

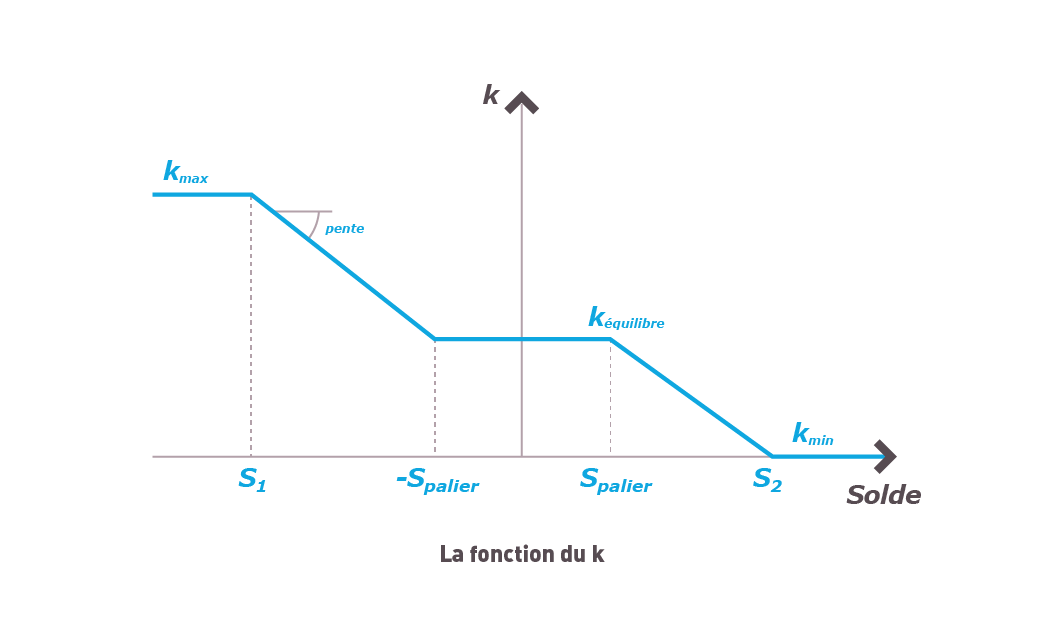

A dynamic ex ante steering of the BIA balance is applied. This is based on the definition of a function capable of meeting the twofold objective of minimising the amplitude of variation in the BIA balance and minimising the volatility of the "k" coefficient, while retaining the possibility of anticipating the variation in this coefficient. This function is made up of several parameters whose values are approved by CRE on the basis of a proposal from RTE.

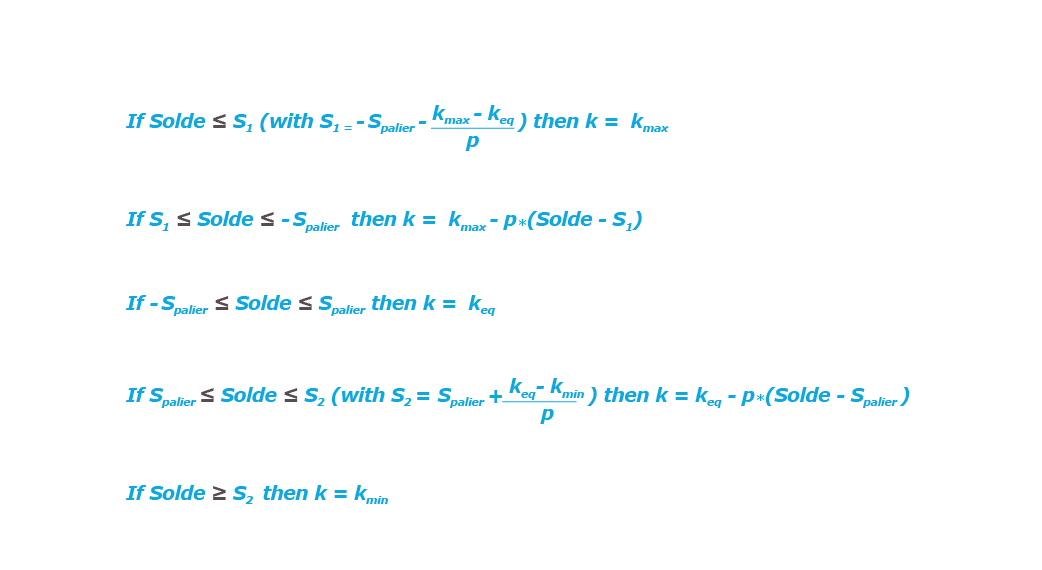

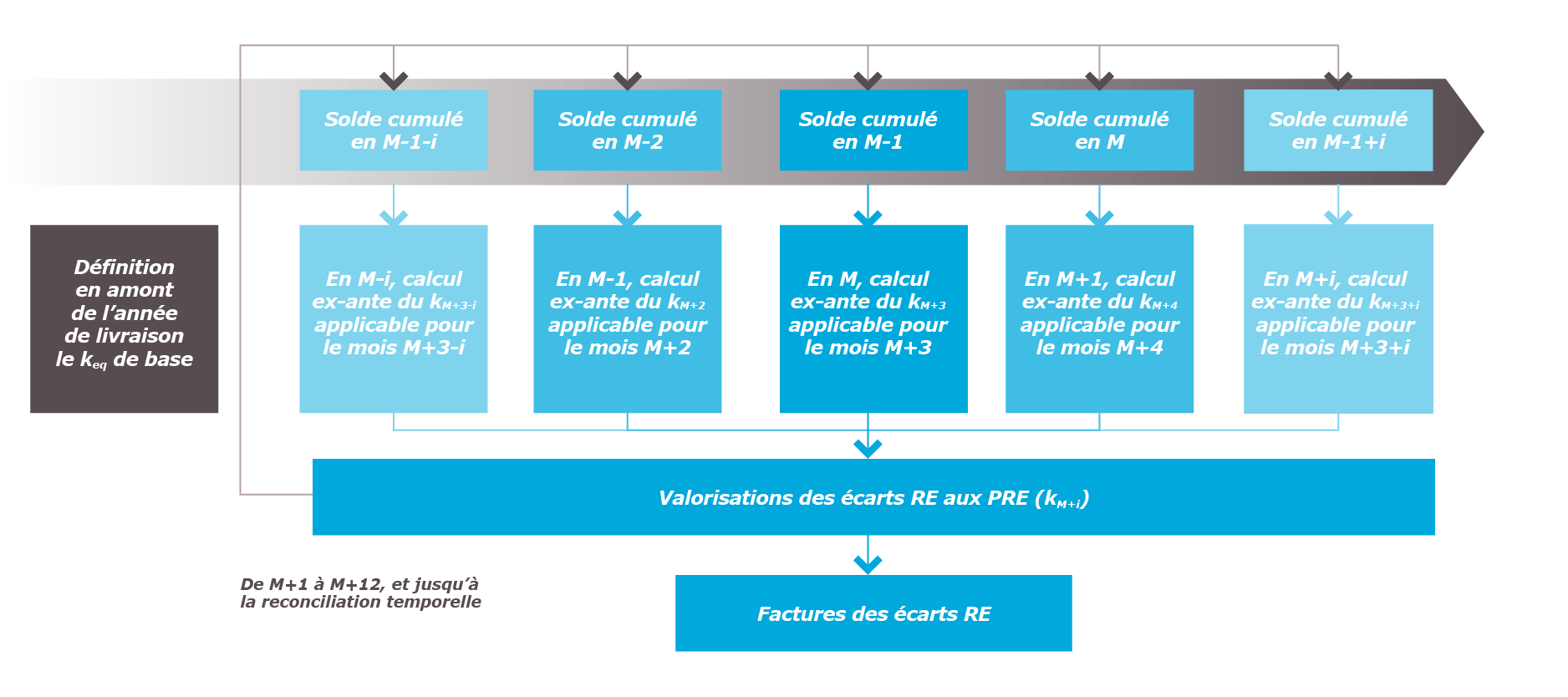

On the basis of this function, the definitive value of the "k" coefficient for a given month is calculated ex ante and at a monthly frequency. More specifically, at the end of each month M (for example, at the end of March 2023), the "k" coefficient applicable for month M+3 (in June 2023 in the example) is calculated on the basis of the cumulative BIA balance recorded at the end of month M for the period up to and including month M-1 (February 2023 in the example). This calculation of the coefficient "k" is carried out according to the following formulae.

In the formulae below, kéquilibre is written keq.

For example, if it is found at the end of September that the cumulative BIA balance for the period up to August is between the values - Spalier and Spalier, then the applicable value of the coefficient "k" for December will be equal to keq.

Taking another example, if it is found at the end of September that the cumulative balance for the period up to August is greater than the value Spalier (and less than the value S2), then the applicable value of the coefficient "k" for the month of December will be equal to keq-p*(Solde - Spalier).

In accordance with the CRE deliberation, the following values have been approved for the purpose of defining the BIA balance steering function:

- Absolute value of the slope of the function (i.e. "p") equal to 0.0015 / M€.

- Value of the reference coefficient for the stabilising level (i.e. "keq") equal to 0.045

- Value of the minimum k coefficient (i.e. "kmin") equal to zero

- Value of the maximum k coefficient (i.e. "kmax") equal to 0.200

- Amount of the balance which frames the stabilising level (i.e. "Spalier") equal to 5 M€.

To initiate this new steering, the BIA balance is by definition zero. Thus, the first value of the coefficient "k" that is applied for January 2023 corresponds to the value of keq. Depending on the steering process applied, and for the launch of this new steering process, the first value of the coefficient "k" which may differ from the keq corresponds to the value applicable to the month of May 2023 (i.e. calculated at the end of February on the basis of the first cumulative balance recorded for January 2023).

Schematically, the new process should follow the sequence below by continuously guaranteeing a definitive value of the coefficient "k" applicable for month M+3 (i.e. for all invoicing deadlines relating to this delivery month). Thus, it should be noted that for each month Mi there is a ki which will be the definitive reference value applied for the valuation of variances for the month Mi in question.

No ex-post replay of the "k" coefficient (i.e. calculation of the "k'" coefficient) is applied for this ex-ante dynamic steering.

It is possible to access the BIA balance publications and the applicable values of the "k" coefficient on the page Download data published by RTE. To do this, simply select the "Market" category, then the “Balancing Imbalance Account" type, and finally "Monthly publication file". It is also possible to use an API to access the applicable value of the "k" coefficient as indicated on the Balancing Imbalances Account page of the Data Portal.

The "energy" component of the balancing-imbalances account (BIA)

The BIA’s “energy” component records the income and expenditure from the BRP system and the balancing mechanism. It makes it possible to monitor the evolution of the BIA balance and thus to steer it, by (1) refunding overpayments or (2) invoicing the negative balance to the BRPs, via the evolution of the value of the coefficient "k".The “energy” component of the BIA includes financial transactions relating to:

- Imbalance settlement of balance responsible parties.

- Balancing and counter-balancing after deduction (or addition) of additional costs from upward (or downward) balancing activated to handle congestion or reconstitution of frequency ancillary services or reserve margins, negative imbalances on the balancing activations (respectively positive) ;

- Invoices issued by RTE to platforms (and vice versa) for balancing energy exchanges within the framework of common merit order lists ;

- Penalties for failure and compensation for non-compliance with the conditions of use of balancing mechanism bids ;

- FCR and aFRR energy (frequency containment reserves and automatic frequency restoration reserves) ;

- Imbalance netting ;

- Invoices issued by other TSOs to RTE (and vice-versa) for the financial compensation of imbalances at borders in the synchronous continental zone.

Additional info